The Sierra County Assessor is an elected official who determines the property value of homes, businesses, and other taxable property within the County for ad valorem tax purposes.

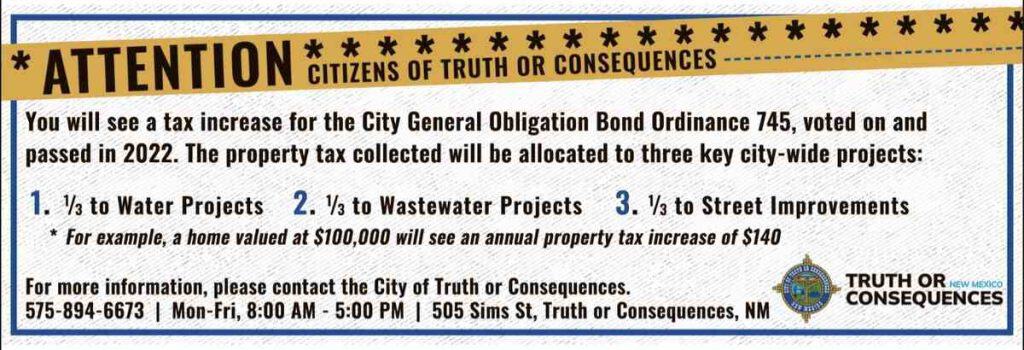

Property in New Mexico is classified as Residential or Non-Residential and taxed accordingly. Tax rates are determined by taxing authorities. Taxing authorities include such organizations as school districts, county hospitals, municipalities, conservancy districts and flood control authorities.

Refer to the New Mexico Taxation and Revenue website for more information.

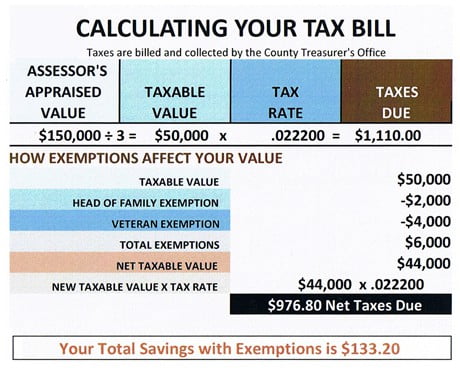

Taxable value on real and personal property is one third of the total appraised value, minus any allowable exemptions, such as Head-of-Household or Veteran’s Exemptions. The Assessor administers the granting of exemptions allowable by state law. Forms to apply are available at the bottom of this page.

The Assessor’s Property Lookup Site may be searched various ways – by physical address, owner number, owner name, zip code, etc. Once you’ve located a record, click the Owner # to see detail on the property, including its current valuation.

Sierra County’s property appraisers are constantly reviewing market and economic trends. New construction is added, and the values of existing land and buildings are constantly under review.

Notices of property valuation are required by law to be mailed out by April 1st of each year.

The Assessor’s office also prepares the tax roll for the County Treasurer for real property (land and improvements), personal property (business equipment), livestock, and mobile homes.